how to pay late excise tax online

If payment is not made within 30 days of the date the City issued the excise tax the Citys Collector-Treasurer will send a demand for the. If you know you will file late you can complete Form 4868 to request an extension.

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

9 am4 pm Monday through Friday.

. To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287. Generally if you hold an excise licence you need to lodge an excise return and pay excise duty before you deliver excisable products into the Australian domestic market. Depending on the circumstances the Department may grant extensions for filing an excise tax return.

Pay personal income tax. The excise is based on information furnished on the application for registration of the. Not just mailed postmarked on or before the due date.

Tax Department Call DOR Contact Tax Department at 617 887-6367. The tax collector must have received the payment. In addition interest will accrue on the overdue bill at an annual rate of 12 from the day after the due date.

Filing electronically is the fastest and most accurate way to file operational reports and excise tax returns with TTB and also provides a secure way to make excise tax payments. Contact Us Your one-stop connection to DOR. Excise Tax on Coal.

Item 1 - Serial Number. How to pay late excise tax online Tuesday March 8 2022 Edit. Notice 2021-66 provides an initial list of taxable chemical substances and guidance for registration with the Form 637 Application for Registration For Certain Excise Tax Activities.

Section 70 1 late fee for. Pay income tax through Online Services regardless of how you file your return. All Massachusetts residents who own and register a motor vehicle must pay the motor vehicle excise annually.

Distributors and noncommercial importers of beer and liquor for sale or use within New York City must pay this tax. You can pay or schedule a payment for any day up to and including the due date. Excise tax return extensions.

Use our penalty and interest calculator to determine late filing and late payment penalties and interest. LICENSE OR REGISTRATION. The Department can waive late return penalties under certain circumstances.

Pay personal income tax owed with your return. You must have Signing Authority TTB Form 51001 or Power of Attorney TTB Form 50008 on file with TTB to submit Federal Excise Tax Returns and. A motor vehicle excise is due 30 days from the day its issued.

The use tax rate is the same as your sales tax rate. However if you purchase a small amount of beer or liquor while traveling outside the City and bring it into the City for personal use it is exempt from this tax. You will generally need to pay excise duty on either a prepayment basis or a periodic settlement basis when you lodge your excise return.

For more information. Internal Revenue Code 4121. File the first taxpayers report with Form 720 for the quarter for which the report relates.

It appears that your browser does not support JavaScript or you have it disabled. If you apply for an extension of time to file and owe tax you need to make your extension payment by the due date. They also have multiple locations you can pay including Worcester RMV Leominster RMV and other locations listed on their website.

For example if you owe 2500 and are three months late the late-filing penalty would be 375. Download and install the application. Use tax unlike sales tax is due at the rate where you first use the article not where.

If an excise is not paid within 30 days from the issue date the local tax collector will send a demand with a fee of not more than 30 dollars. 2500 x 005 x 3 375. Please use this page to search for delinquent MOTOR VEHICLE EXCISE TAX bills.

Department of the Treasury. Only use this calculator when youre sending your return and payment together You can also see current interest rates for the most recent quarterly interest rates assessed on. File and Pay Online.

If youre more than 60 days late the minimum penalty is 100 or 100 of the tax due with the return. You are personally liable for the excise until the it is paid off. Log in to your account.

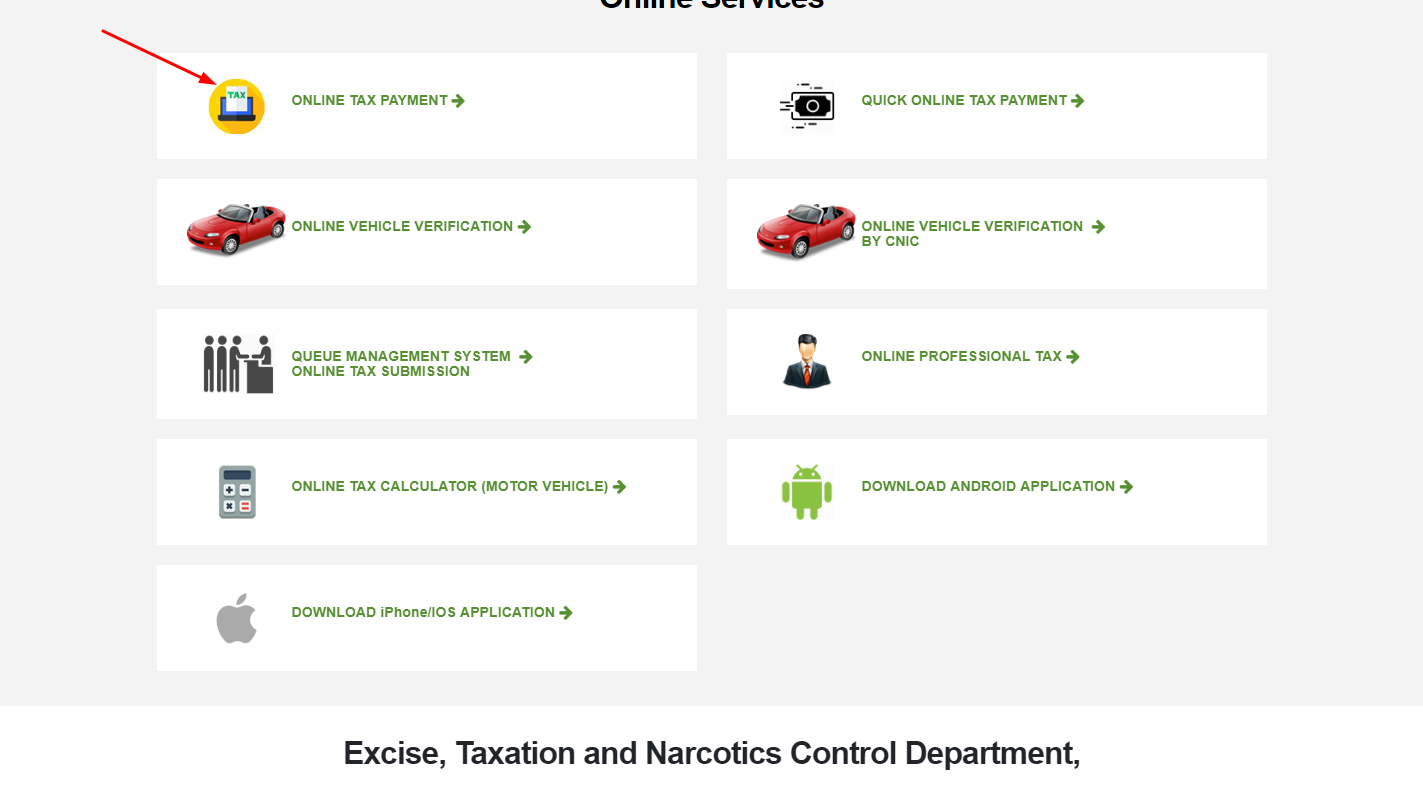

The taxes will be reported on Form 720 Quarterly Federal Excise Tax Return and Form 6627 Environmental Taxes. Applying for Vehicle Token Tax in Punjab Pakistan and obtaining a challanPSID is the procedure to be followed. Your obligation as a taxpayer will depend on your circumstances and business type.

If JavaScript is disabled in your browser please. Write EXCISEFIRST TAXPAYERS REPORT across the top of a separate copy of the report and by the due date of Form 720 send the copy to. Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660.

As a TTB-regulated industry member you may be responsible for paying federal excise taxes. You must create a serial number in this format. The city or town where the vehicle is principally garaged levies the excise and the revenues become part of the general funds of the municipality.

Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089. To complete a search you must provide several pieces of information to ensure we match you to the bills in our system. Late-filing penalties can mount up at a rate of 5 of the amount due with your return for each month that youre late.

If the demand is not answered within 14 days the collector. Hawaii General Excise Tax Form G-45 is the periodic form that must be filed at intervals throughout the year. Receive email updates Sign up for DOR news and updates.

There is no statute of limitations for motor vehicle excise bills. If you dont make your payment within 30 days of the date the City issued the excise tax interest and fees are added to your bill. In this example 2000 is the calendar year covered by the excise tax return and 01 and 001 are the number of the PERIOD excise tax return filed for the year.

You dont need to give any reason for why youre filing lateif you complete this form you get an automatic extension until October 17 to file your taxes without the late-filing penalty. The Excise Taxation Department will be selected in Step 5 and the Token Tax will be. Calculate late filing and late payment penalties and interest.

Online payments will have a NON-REFUNDABLE 45 convenience fee added to your total LastCompany Name. 2000-01 for PERIOD returns and in this format P-2001-001 for PREPAYMENT returns. The request must be made before the due date.

New York State Beer and Liquor Excise Tax. Filing an abatement application does not excuse you from paying the excise bill. Ad TurboTax Can Help Whether You Filed An Extension Or Not.

Stay current with filing frequencies and operational reports excise tax and export due dates by subscribing to receive automated reminders when it. Taxes and Filing. There will be a convenience fee associated with an online payment.

If you requested an extension. Paying excise duty on excisable alcohol. Register with the application.

MassTaxConnect Log in to file and pay taxes. However keep in mind that even if. Excise Tax - Options Provide participant notice Pay excise tax to plan Pay excise tax to IRS Excise Tax PTE 2002-51 Relief Eligibility NOT late more than 180 days NOT taken advantage of this.

Tds Payment How To Make Tds Online Payment

Digital Tax Stamp Businesses Must Comply With New Excise Tax Norm Digital Tax Consulting Business Chartered Accountant

Different Types Of Australian Taxes Types Of Taxes Tax Services Business Advisor

One Stop Solutions For All Your Courier Needs Easyshipping With Exciting Rates For International Sellers Import Exp Solutions Online Marketing Business

Pin By Karthikeya Co On Tax Consultant Indirect Tax Custom Last Date

Online Bill Payment Town Of Dartmouth Ma

Corporate Excise Tax Penalties Waived S Corporation Fiscal Year Corporate

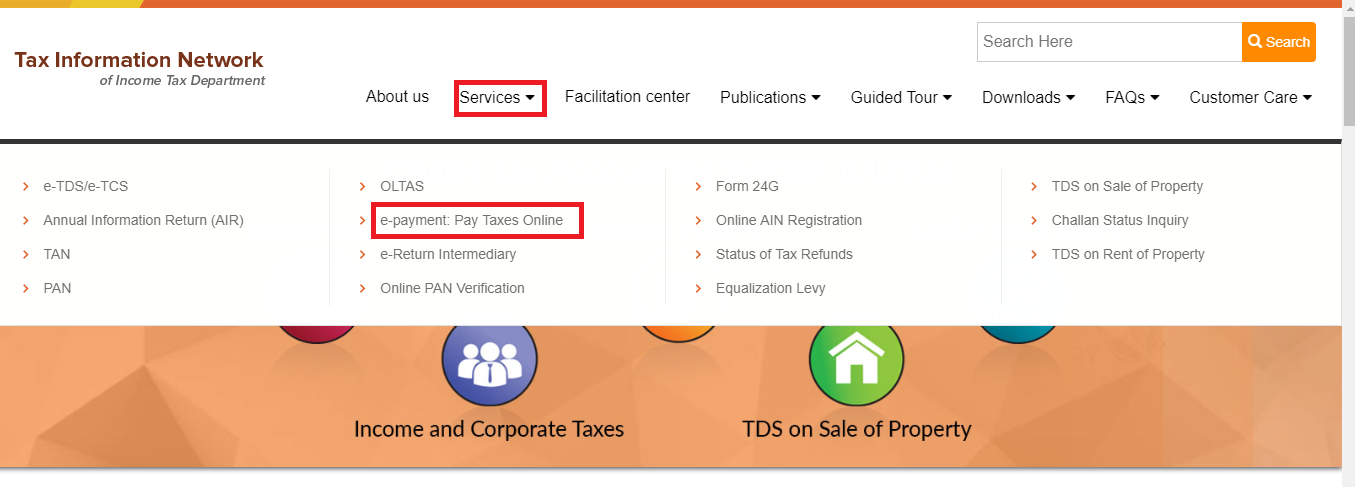

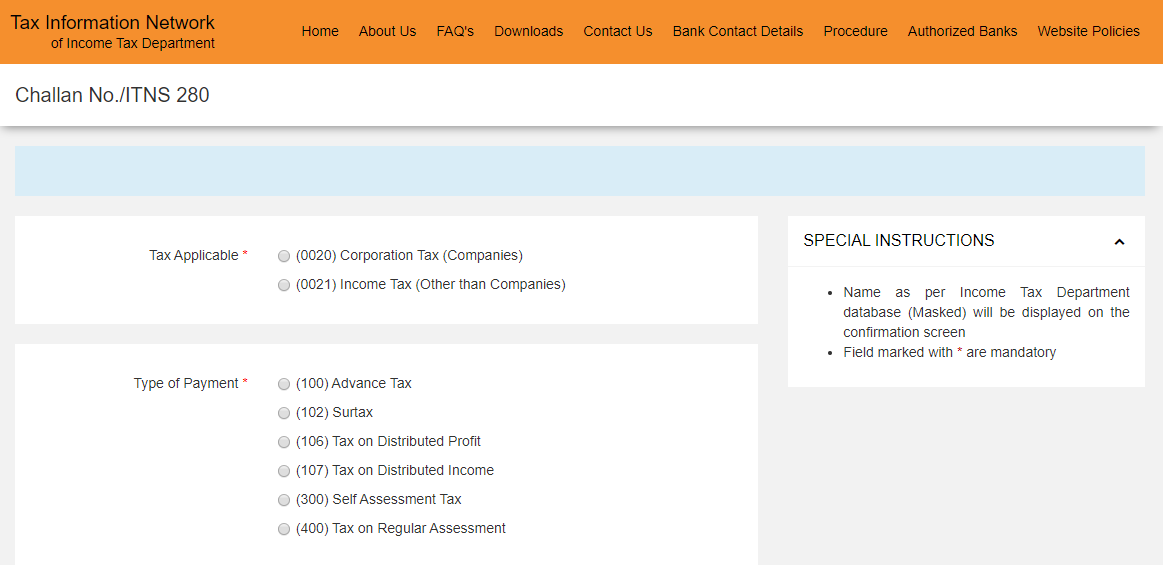

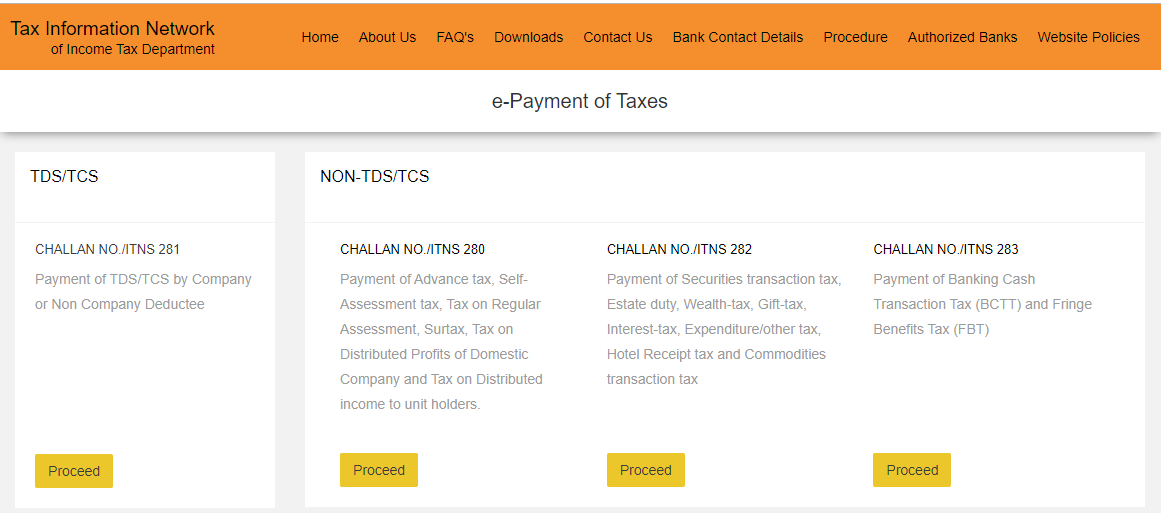

How To Pay Calculate Income Tax Dues Online Paisabazaar Com

How To Pay Calculate Income Tax Dues Online Paisabazaar Com

How To Pay Calculate Income Tax Dues Online Paisabazaar Com

How To Pay The Irs With Eftps Hourly Inc

Penalty For Late Filing Irs 1099 Information Return Irs Forms 1099 Tax Form Irs

Top Benefits By The Best Gst And Income Tax Service Providers In 2022 Filing Taxes Online Taxes File Taxes Online

How To File And Pay Sales Tax In Hawaii Taxvalet

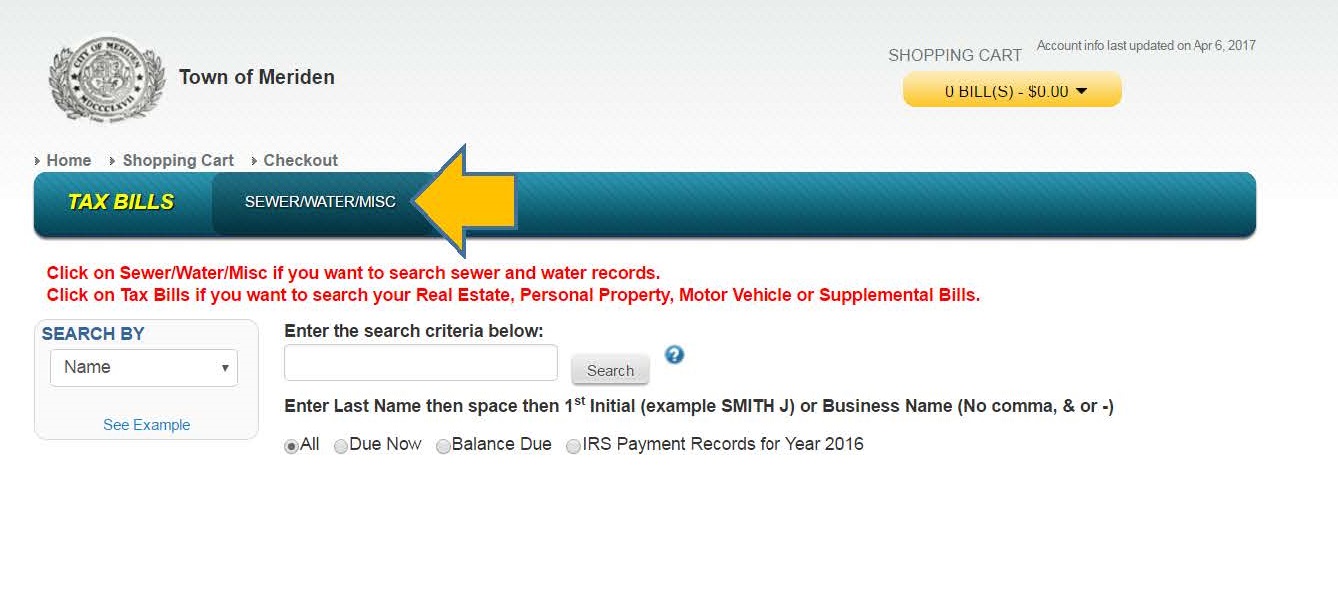

View Or Pay Your Taxes Utility Bill Online

Steps To Pay Due Income Tax Via Online